News +

Insights

Thought Piece: Avoid the urge to “Time the Market”

Stock market volatility has returned in the first half of 2022. While our dividend growth equities have not experienced the same volatility as other segments of the stock market, seeing a short-term drop in market value on your statement can cause anxiety. The news media exacerbates the unease by repeating the same headlines… “inflation, inflation, inflation, possible recession, possible recession, possible recession”. Then the brain’s amygdala may kick in and produce a chemical reaction creating “fight or flight” syndrome. When investing, “flight” leads to thoughts of selling out of the market “until the dust settles”.

Strong investment performance is derived by the combination of a sound investment strategy and patient investment behavior. Long term equity investors are rewarded with growing dividends and appreciation by tolerating the volatility that short-term investors create. Timing the market to avoid stock market volatility is a fool’s errand and advised against for many reasons such as:

1. Realizing a Loss – Once you start feeling the unease and impulse to sell, you have already experienced much of (if not all) of the decline.

2. Missing Return of Appreciation – The return of price appreciation can be sudden and quick. Often before the storm has passed, stock prices will return to growing. Consider the Spring of 2020, the S&P 500 was up 12.68% in April after the significant market correction of February and March.

3. Missing Dividends – Dividends are a significant portion of long-term total returns. The cash flow is a consistent form of return, and it provides for expenses during volatility or can be reinvested at lower stock prices.

4. Taxes – If you have a taxable account with long term holdings and you sell, you are realizing gains and will pay an expense in the form of income taxes.

5. Lack of peace of mind – Market timing leads to watching the market which leads to an emotional roller coaster.

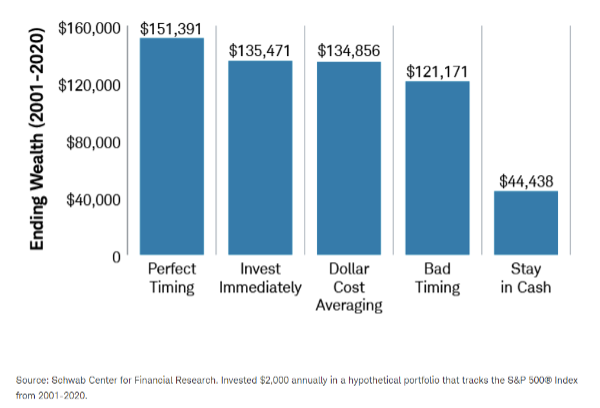

What if you have cash to employ? Before you consider the inclination to time buying in, consider the Charles Schwab market timing study from 2021. Schwab ran the numbers of the following five scenarios (S&P 500 2001 -2020):

1. Perfect Timing – Investing $2,000 on the best day (lowest price) of every year

2. Investing Immediately – Investing $2,000 on the first day of every year

3. Dollar Cost Averaging – Investing $2,000 spread evenly across the first day of every month of every year 4. Bad Timing – Investing $2,000 on the worst day (highest price) of ever year

5. Stay in cash – Invested $2,000 per year in treasury bills

Results Summary: Given how unlikely it is you will always perfectly time the investment and the cost of holding excess cash over time (and lack of peace of mind), investing immediately or dollar cost averaging are the smartest solutions for investors. Dollar cost averaging can help avoid the procrastination of investing and minimize regret by spreading the purchases over several months – and you get peace of mind!

While volatility is a part of equity investing, it is important to have a financial plan to help you navigate these events so that you stay on track for achieving your financial goals with peace of mind. Within that plan you should make sure you have enough dividend income to meet your cash flow needs or consider investments with a fixed maturity (such as a bond or CD) to protect against the need to withdraw principal on short notice. If less volatility helps you sleep at night and you can afford to reduce your return expectations, consider an allocation to fixed income in your portfolio.